18 August 2021

The IAASB has now issued its proposed standard on less complex entities (ED-ISA for LCE) for feedback.

A standard around LCE’s is long overdue, and their proposal comes with the hope of easing unnecessary requirements placed on auditors.

The standard is expected to come into effect around 2024 and should be a game-changer for the audit of most of our client entities. This article follows on from prior commentary and summarises some of the critical changes the LCE standard will have on an audit engagement.

Relationship to ISAs

The IAASB has decided that the proposed standard is to be separate from the ISAs with no intended need to directly reference back to their requirements or application material. However, the proposed standard does not address complex matters or circumstances so is not permitted to be used for audits that are not audits of financial statements of LCEs.

As a consequence, when a firm is auditing an entity with transactions and accounts deemed less complex, it cannot supplement by using other auditing standards concerning a more complex account or transaction (like an accounting estimate calculated using a bespoke, complex model). In this instance, the auditor may not use ISA for LCE together with requirements from say ISA 540 (Revised) to supplement what may not be addressed in ISA for LCE when planning and performing the audit. They would need to carry out the whole audit using ISAs (see Explanatory Memorandum para 26-28).

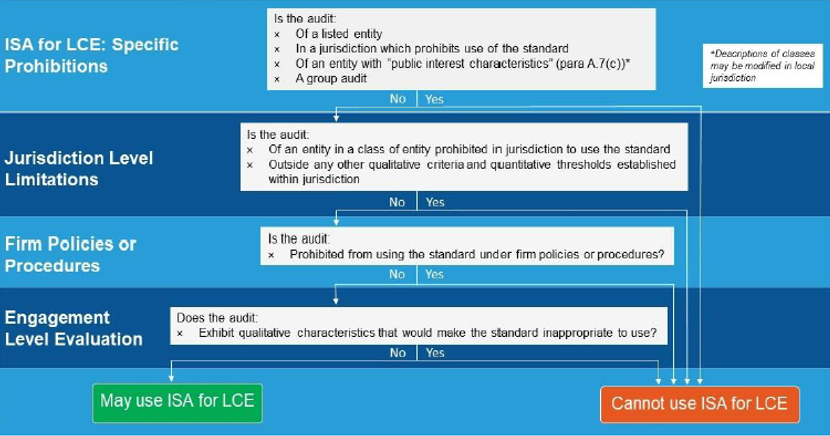

Therefore, it will be critical in the planning stage to ensure the LCE standard is applicable to every aspect of the audit engagement. The standard provides good guidance around the applicability of LCE for an audit engagement. See the table below:

What Qualitative Characteristics might make the standard inappropriate?

Outside of the specific prohibitions in the table above, an entity may be prohibited from using the LCE standard where an entity exhibits:

- Complex matters or circumstances relating to the nature and extent of the entity’s business activities, operations and related transactions and events relevant to the preparation of the financial statements.

- Topics, themes and matters that increase or indicate complexity, such as those relating to ownership, corporate governance arrangements, policies, procedures or processes established by the entity.

(from Explanatory Memorandum para 67)

What about groups?

At this stage, the standard is unlikely to allow group audits; however, the board is open to changing their minds and has proposed options to incorporate group audits into the standard.

Flow of the proposed standard

The content of ED-ISA for LCE has been grouped into nine “Parts” that follow the flow of an audit engagement (rather than by subject matter or topic like the ISAs):

Each part follows the same structure, a preface, authority (circumstances in which the standard is prohibited or limited), broad concepts, key requirements, and appendices.

Potential Grey areas in the application of the standard

Accounting estimates – Specific procedures concerning the use of complex modelling and detailed requirements to address situations where there is higher estimation uncertainty have not been included as they are not expected to be relevant for the types of accounting estimates in an audit of a typical LCE. While the presence of one complex characteristic exhibited by an entity does not necessarily exclude the use of ISA for LCE this is a tricky area that would lead to a judgement call for the auditor about whether it is still appropriate to continue performing the audit under the proposed standard. The auditor would need to determine if the complex matter or circumstance identified is not in the spirit of what standard is intended to be allowed as an accounting estimate.

Service Organisations – The standard is designed for the typical nature and circumstances of an LCE. The prime example is with LCEs that have payroll processed by a service organisation. However, situations deemed more complex relating to the entity’s use of a service organisation have not been addressed within the proposed standard. For example, requirements relating to an auditor’s ability to rely on reports on the operating effectiveness of controls from the entity providing the services (e.g., ‘Type 1’ and ‘Type 2’ reports) are not included as it is anticipated that where transactions are less complex, the auditor would be able to obtain the necessary audit evidence without difficulty from records available including, if applicable, in relation to controls at the service organisation.

Planning the Audit

One of the areas where the IAASB has modulated the proposed standard is to not distinguish between the overall audit strategy and the audit plan required by the ISAs. The auditor is still required to plan the audit in the same manner, however, the relevant outcomes of what the auditor would need to do about establishing the overall audit strategy and audit plan have been incorporated together (i.e., there is still a requirement to establish and plan the audit’s scope, timing, and direction).

IAASB Video

The IAASB has released a video explaining the draft standard:

Audit Assistant response

Our goal is to make a new template from scratch incorporating the requirements of the new standard, in anticipation of its adoption. As a clean-slate build, we will be looking at ways to make this as efficient as possible, without having to retain backward compatibility. Please contact us if you would like to add to our submission on the ED, or make suggestions for the new template.