25 July 2022

Does your firm administer any family trusts? Then you will no doubt be aware of the increased requirements under the Trusts Act 2019 for ensuring all the data about the Trust is up to date.

To help achieve this, we have, in collaboration with a large local Accountancy firm, developed a simple questionnaire to be shared annually with the trustee contact, that asks all the relevant questions to make sure that the accountant’s records are correct.

There are four actions required:

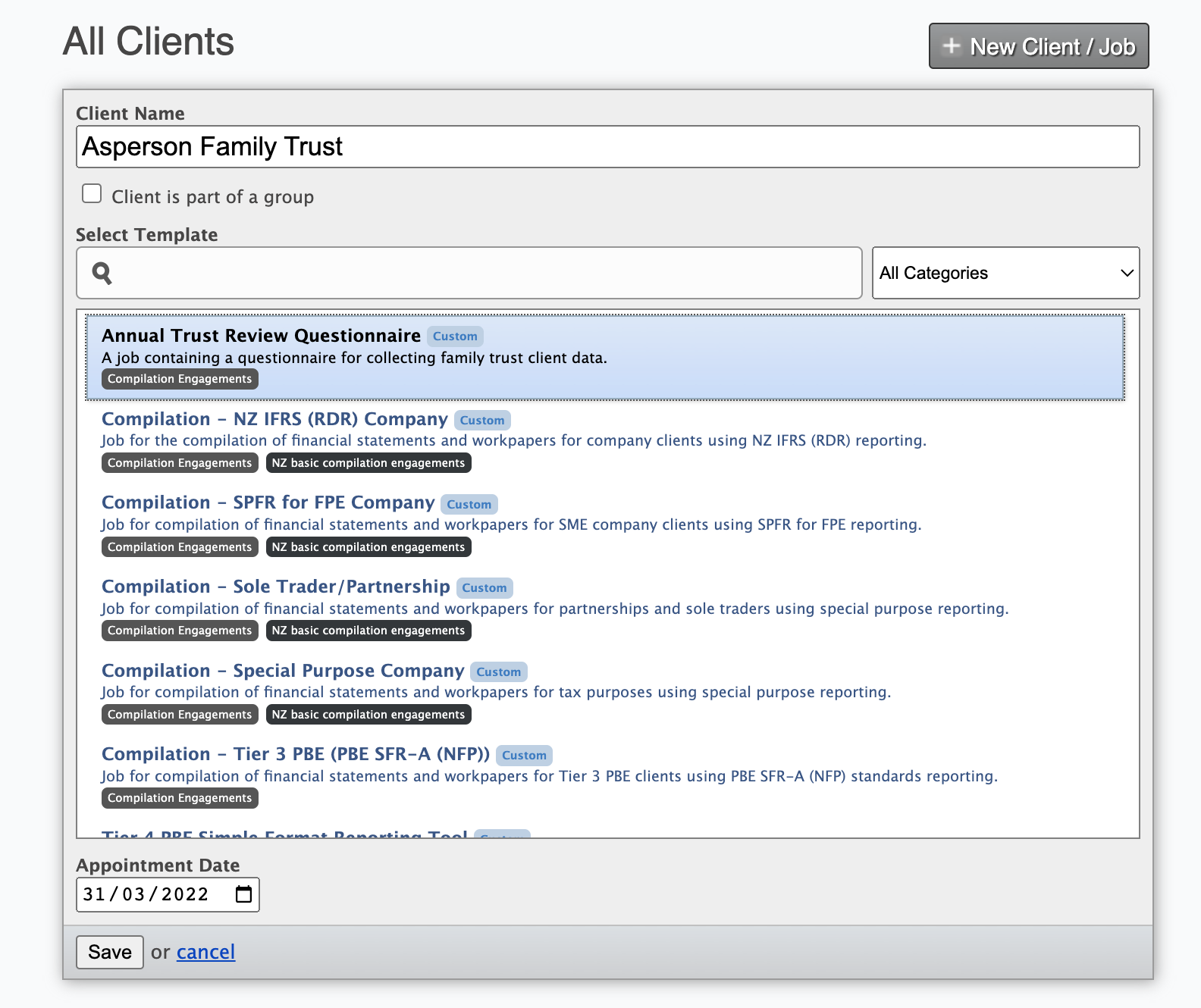

STEP 1: Set up the Trust using the Annual Trust Review Questionnaire template. Add the name of the trust, appointment date and save (the questionnaire itself is undated – the important date is when it is signed off).

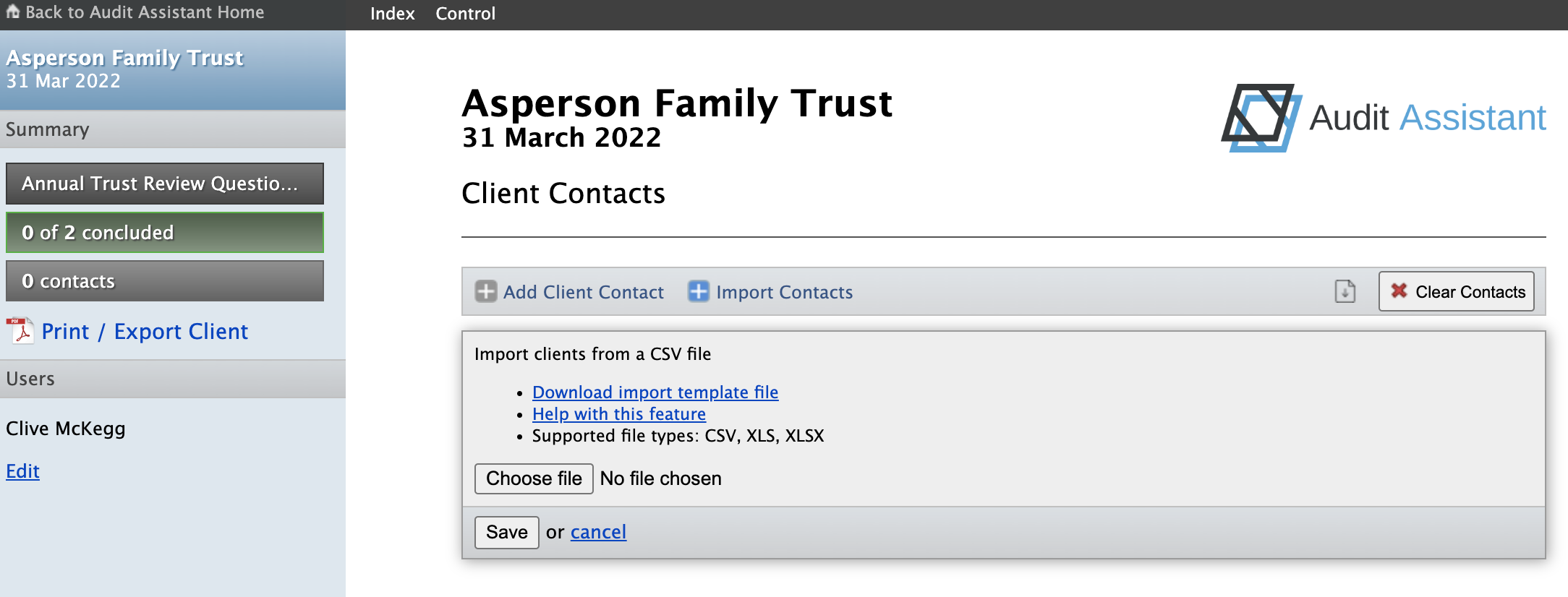

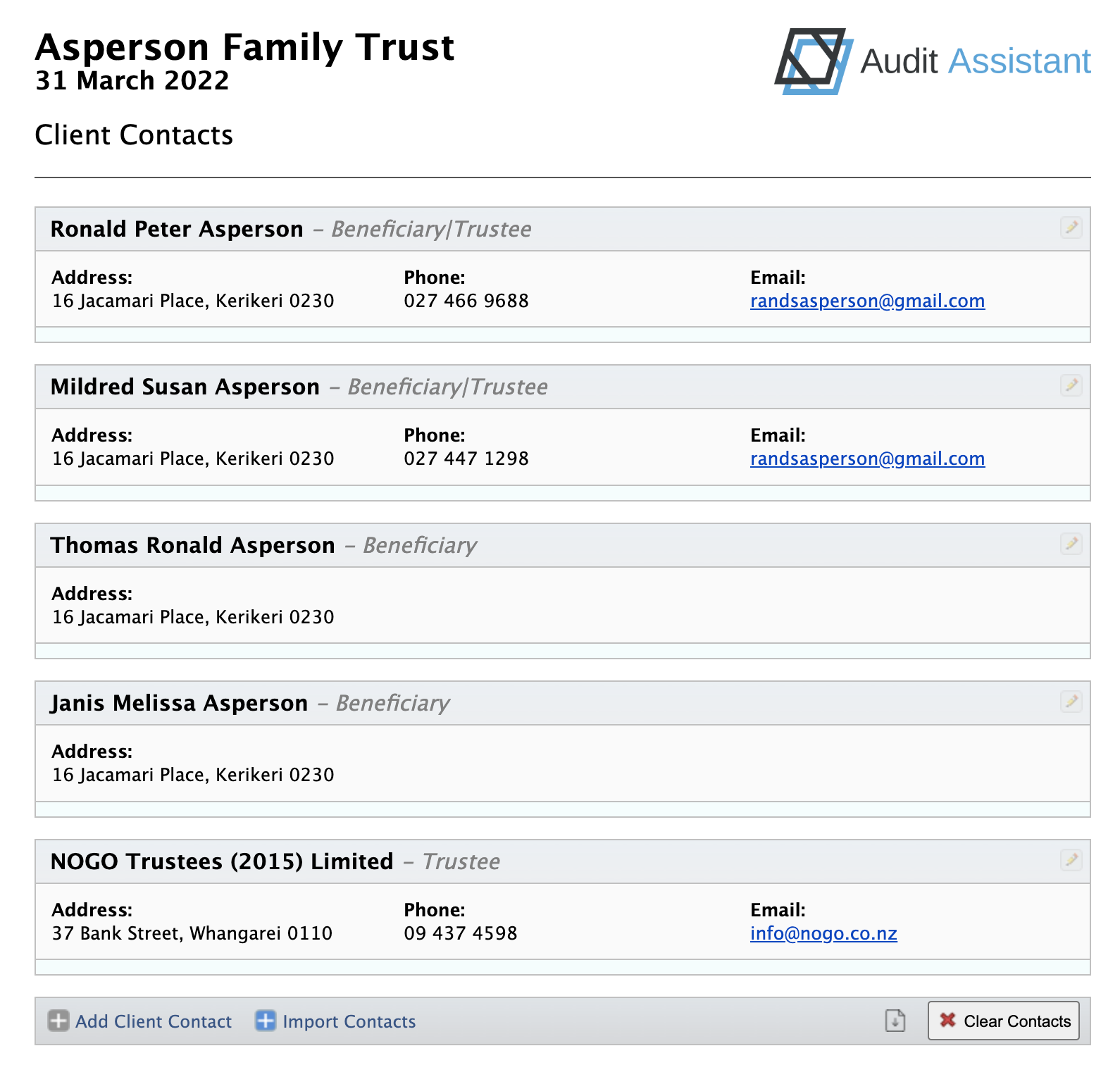

STEP 2: Add the current trustees and beneficiaries as contacts. These can be imported using a special .CSV template that we have attached to the A1 page, from data obtained from your records (or the details may be added one at a time if there are only a few).

Note that the Role column should specify whether the person or entity is a Trustee, Beneficiary or both – note format for both uses the vertical line or “pipe” character (|).

The contacts will then be added to the file so that they will appear on the questionnaire.

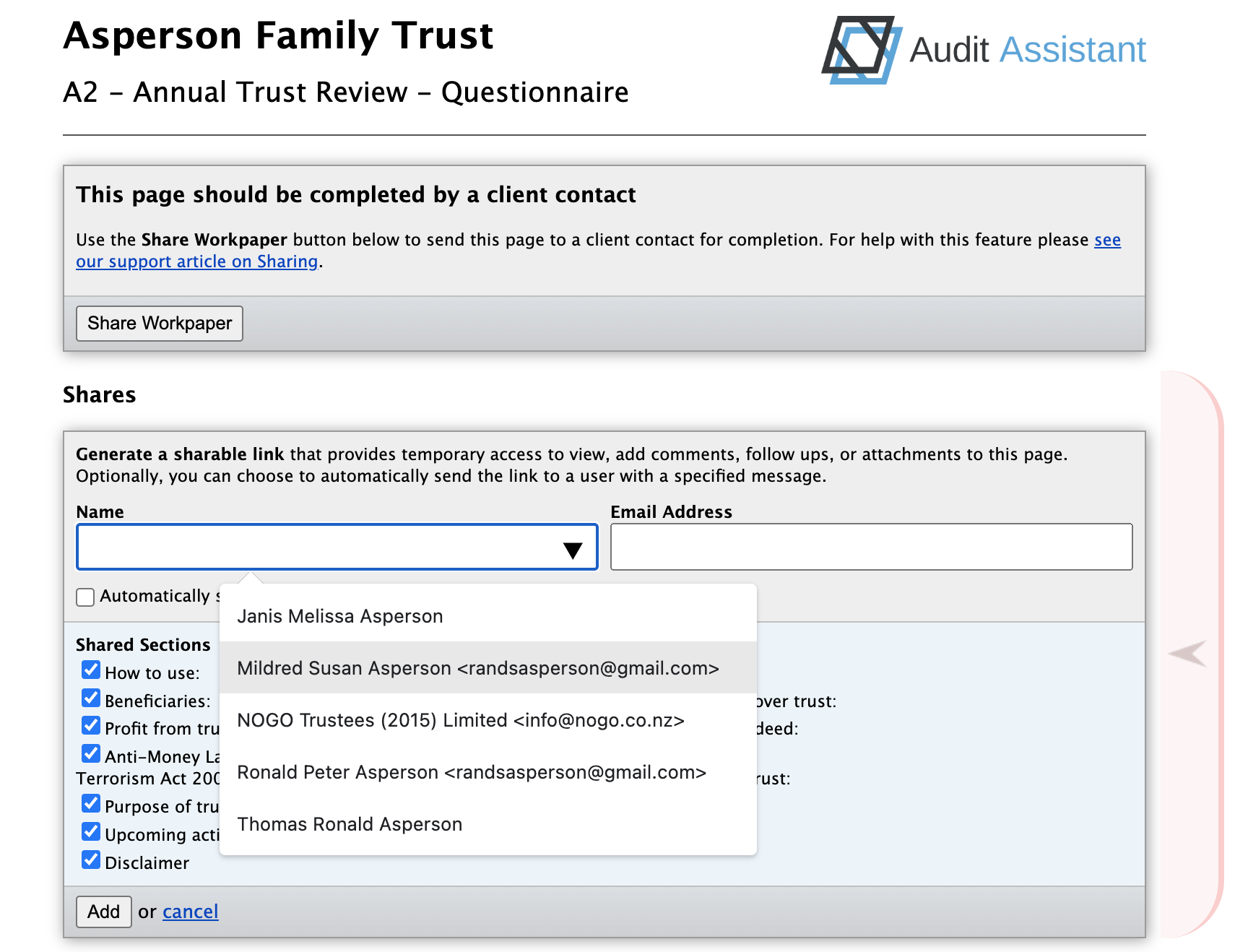

STEP 3: Then share the questionnaire page with the relevant contact. Select the name from the dropdown and click add – this will generate a link to be emailed to the client. Alternatively use the tick-box “Automatically send link to user” to generate an email directly off the system.

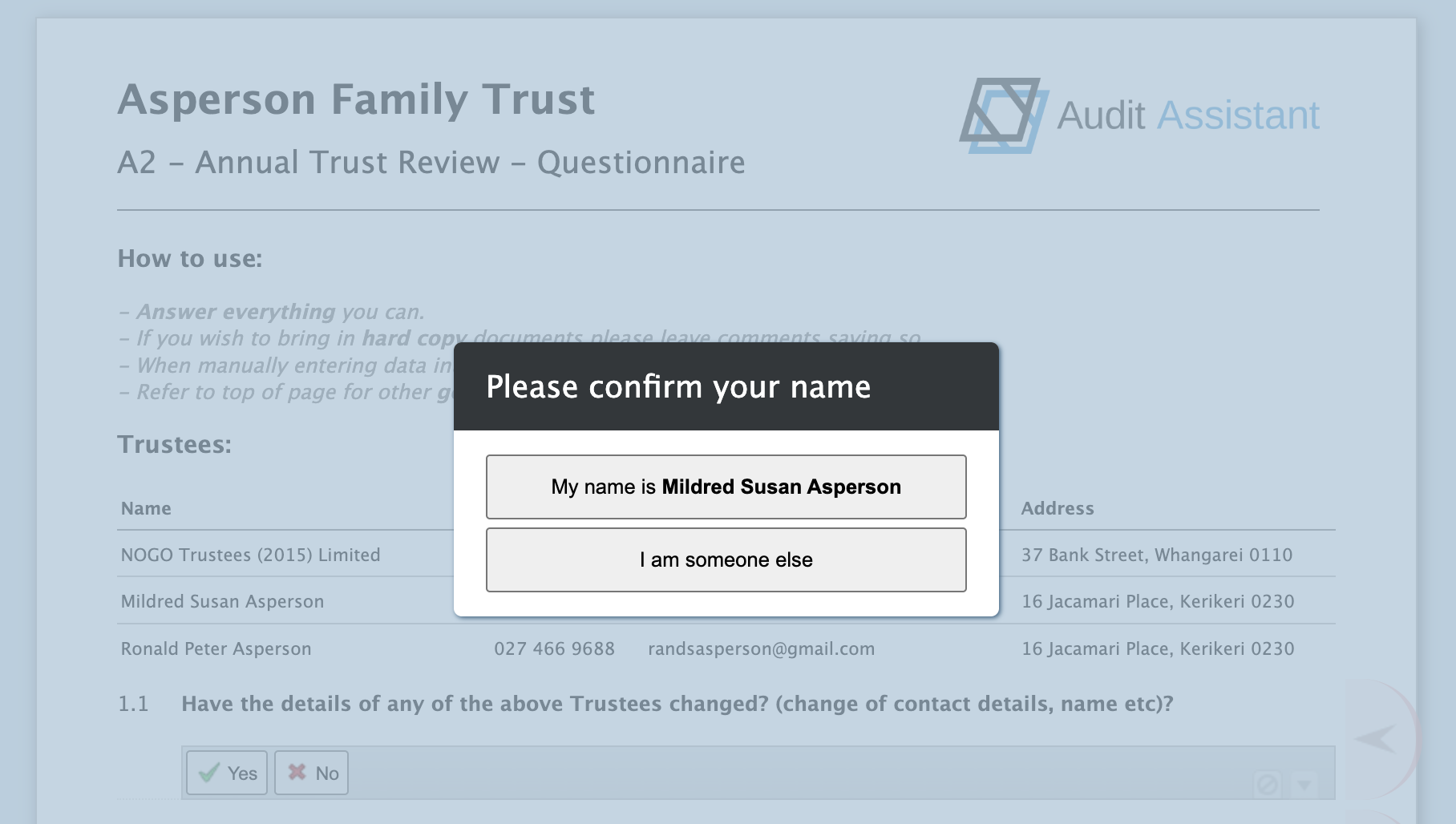

They receive an email from your firms asking them to follow the link and complete the details. Following the link they are asked to confirm their identity:

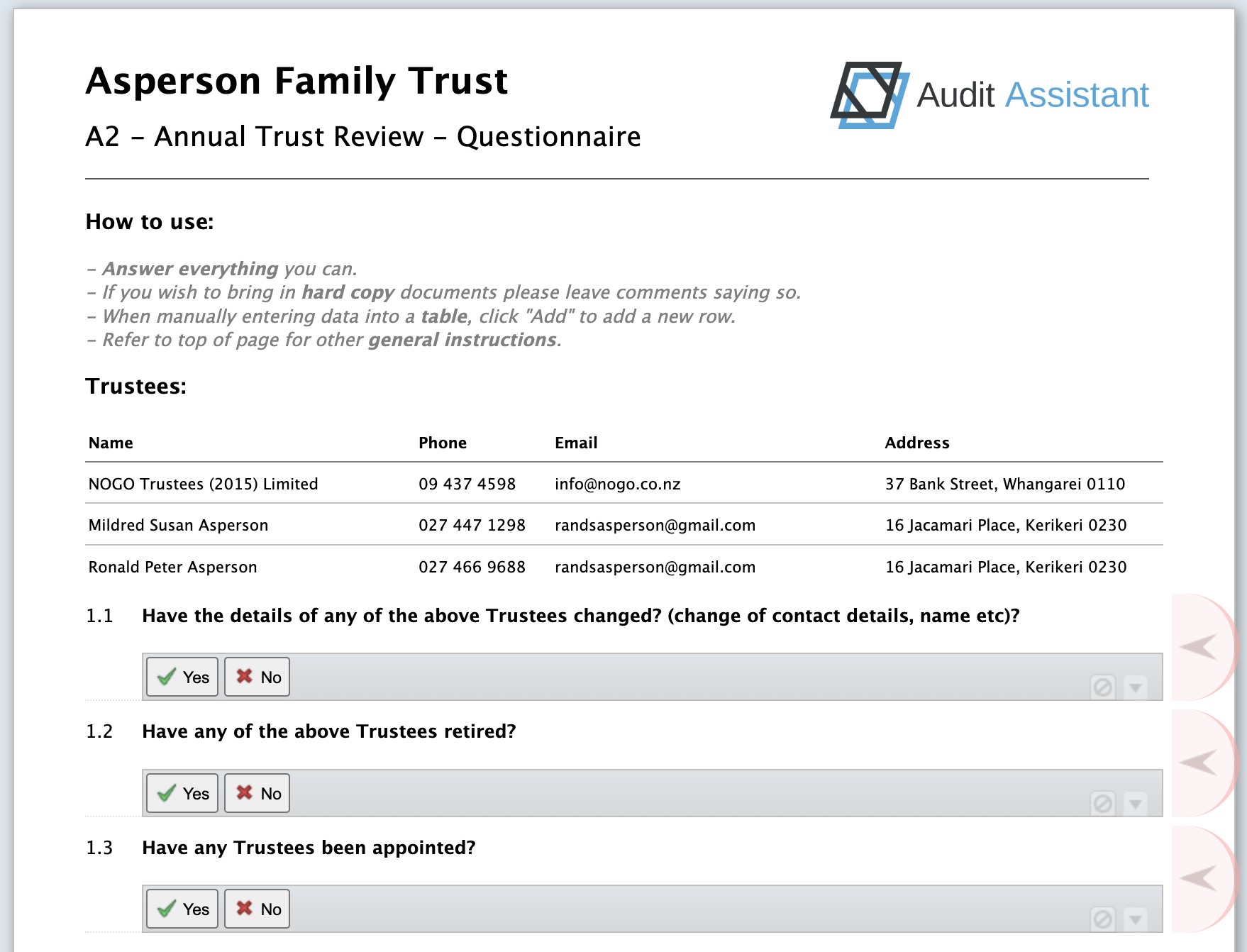

Then they see the existing trustee and beneficiary contact details and are asked if any changes have been made.

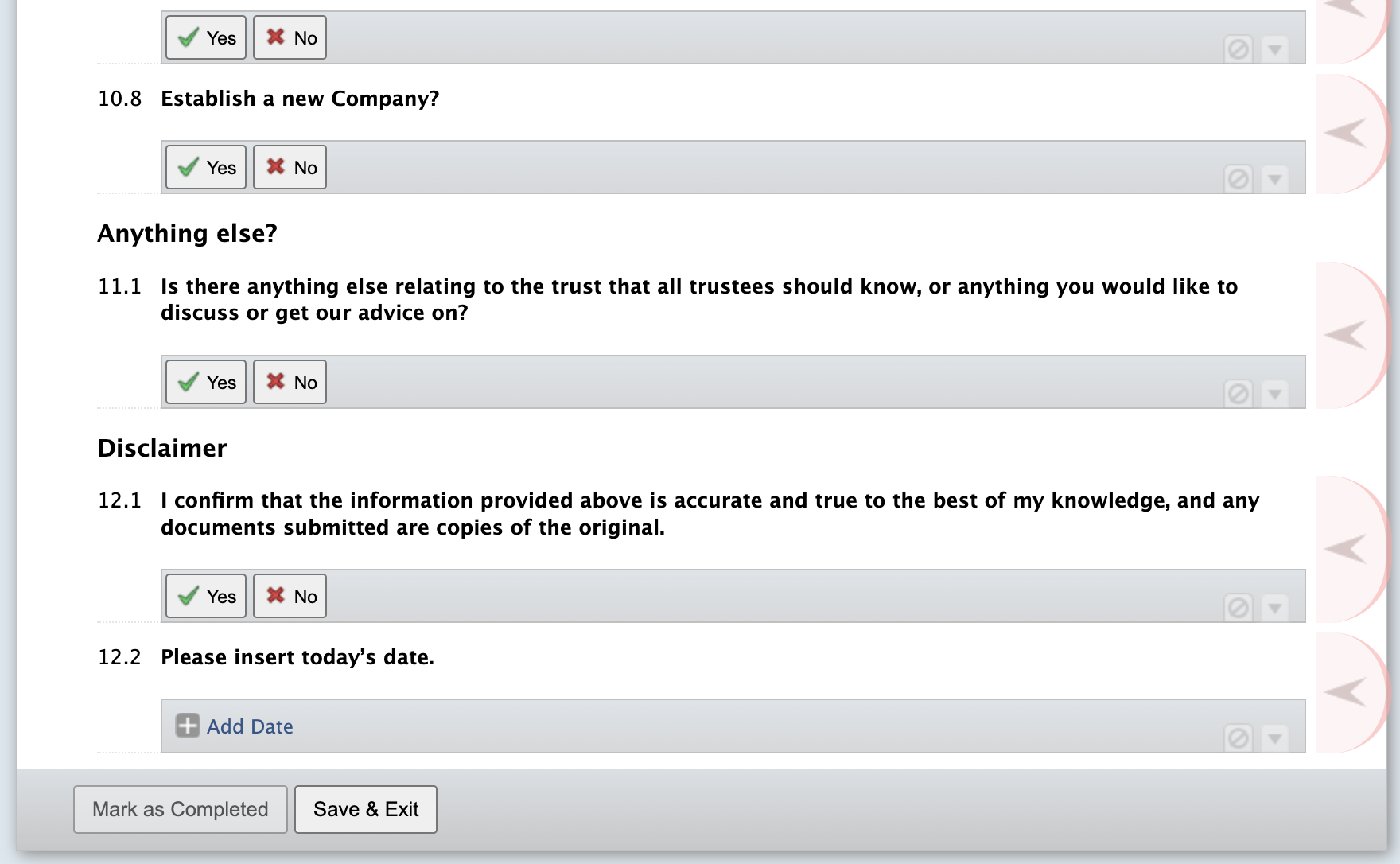

If so a dialogue box asks them to type in the new details. There are also questions for all the other information that needs to be asked under the Act. Once complete the accountant is notified.

STEP 4: The accountant then updates the records held by their firm, and takes any further actions required.

Once complete the jobs may be saved to PDF then deleted off the system, or rolled over and reused in the subsequent year.

Note: We can assist with bulk client creation, contact data import, and even bulk sharing if required, as we do for normal client annual data collection questionnaires.

This content is accessible in our Tools for Accountants packages, along with financial reporting checklists and other compilation tools. Contact us for more details.