5 September 2023

For those who prepare and audit financial statements for “small” (under $5m expenditure) charities and other not-for-profits, there are some important changes coming up.

In New Zealand, these smaller entities are very common – there are about 30,000 of them including some soon to be included in this reporting under the Incorporated Societies Act 2022.

The Standards have a mandatory date of 1 April 2024, meaning they must be applied for accounting periods that begin on or after 1 April 2024. A Tier 3 or 4 entity may choose to apply the Standard before the mandatory date for accounting periods that end after the Standard takes effect on 15 June 2023.

The Tier 3 standard – now called “Tier 3 (NFP) Standard – Reporting Requirements for Tier 3 Not-for-Profit Entities” – continues to be accrual-based. And Tier 4 – now called “Tier 4 (NFP) Standard – Reporting Requirements for Tier 4 Not-for-Profit Entities” – is a cash-based alternative for smaller entities (under $140k expenditure).

This article focuses on the Tier 3 (NFP) standard, which tends to be much more commonly used than the cash-based standard even for many smaller entities – as it is much more like traditional reporting. We will look briefly at the Tier 4 changes at the end.

Service performance

When the standards were introduced there were no NZ reporting or auditing standards for Service Performance Information (SPI). Now we have PBE FRS 48 for Tier 1 and 2 entities, and NZ AS-1 (shortly to be NZ AS1 (Revised)) for the audit of Service Performance Information (SPI) across all the tiers.

In a way, the changes in Tier 3 are simply following the direction set by PBE FRS 48 and NZ AS-1. The terms Outcome and Output were always confusing, so these are being replaced with more descriptive terminology as per PBE FRS 48.

There is also some helpful guidance provided about what to report as SPI, and how to report it. Reporting must be (as per para A14):

- Relevant and faithfully represented

- Understandable

- Timely and comparable

- Verifiable

As such, any changes in reporting from the prior year must be explained, so there is consistency in reporting.

From an audit perspective, NZ AS-1 (Revised) is a great improvement on the previous more complex standard that now feels like a better fit for smaller entities.

Changes to standard revenue and expenditure categories

A common criticism of reporting under the existing Tier 3 standard was that the reporting categories were so broad as to be almost meaningless in some cases. The new standard splits some of the categories into smaller classifications. For instance,

- Commercial activities are split out;

- Grants for capital projects are split from other grants;

- Government funding is split from non-governmental funding;

- Donations are now clearly differentiated from membership fees and subscriptions;

- Employee remuneration (apparently including those paid as contractors) is to be split out from volunteer and other employee expenses.

Preparers of performance reports will be able to tweak the names of the categories, but will not be allowed to add additional categories as before. (para A68) This is probably for aggregation and analysis purposes. This will make the Statement of Financial Performance more meaningful and reduce the need for extensive notes breaking down the categories.

Revenue recognition changes

The old standard was fairly inflexible in matching revenue from grants and other bequests and gifts with the use of that money. Donations with a use or return condition were recognised as the condition was fulfilled. Any income without such a condition was recognised in the period it was received.

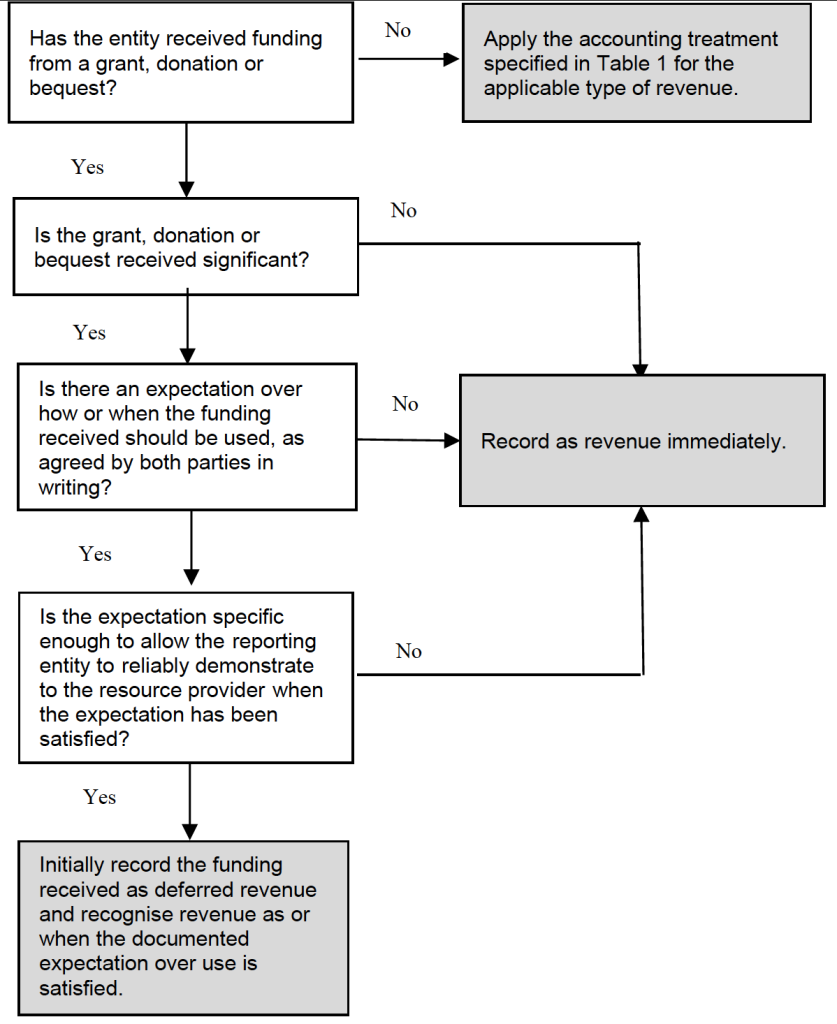

Under the new standard, if there is a clear expectation of when funds are to be used in terms of an agreed expectation from the grantor, the revenue may be recognised as or when the conditions are satisfied. See the decision tree below which is from the standard:

This seems like a clear, common-sense response, more in line with the commonly accepted matching principle of accrual accounting.

Alternative measurement for assets

Under the old standard, if fixed assets are revalued, the Tier 2 standard must be used. The new standard allows revaluation based on say, RV (rateable value) for land and buildings, or valuation by an independent qualified valuer. (para A133) Depreciation must still be calculated on revalued assets. (para A134)

Changes are made straight to a separate property, plant and equipment revaluation reserve within accumulated funds in the Statement of Financial Position. The whole class of assets must be revalued. Once a revaluation is made there must be consistency going forward, with no changing back to other methods, and revaluation updates made on a regular schedule. (para A139)

Assets classed as investment properties may be accounted for in the same way. (para A144) Where an entity holds investments that are publicly traded, it may elect to measure that class of investment at its current market value. (para A145) It may elect to recognise gains/losses on revaluation of publicly traded investments either in revenue or expenses in the statement of financial performance, or in accumulated funds in a separate investment revaluation reserve. (para A148)

Accumulated funds

In the old standard, there was no requirement to disclose any details of accumulated funds. The new standard says that to make information understandable to users, the balance of accumulated funds is to be aggregated and presented separately in categories, as applicable. These include any capital contributed by owners, accumulated surpluses or deficits, revaluation reserves (as above), restricted and discretionary reserves, and any other reserves. (para A175)

For transparency, there is to be a note that discloses objectives and policies for managing accumulated funds and any plans for applying accumulated funds to meet the entity’s objectives. (para A231-A235)

This seems to be designed to make entities think about why they have significant reserves (if in fact, they do) and perhaps how they could be better using these to meet their objectives. If they view their reserves as investments, are they making the best use of their capital? Could they be meeting their objectives in more efficient ways with a redeployment of their equity?

On the other hand, many charities certainly don’t have excess cash or investments and their equity simply represents assets such as land and buildings that are essential to their service delivery. Having to make up a nice story to put into a note in these cases seems a bit pointless – and could be difficult to audit.

Simplification to the statement of cash flows

Cash flow statements are typically a headache for both preparers of financial statements and auditors. Accounting software often struggles and the results are hard to audit and hard for users to understand.

The new standard aligns the categories in the Statement of Cash Flows with the categories in the Statement of Financial Performance. The Statement of Cash Flows is to be essentially a statement of receipts and payments.

Tier 4 changes

There are a couple of changes for Tier 4 (NFP) reporting. These reflect the changes in categories for Tier 3, changing the language around outcomes and outputs, removing the need for a “Statement of Resources and Commitments” and replacing this with significant assets and significant liabilities listed in the notes. The name of “Statement of Receipts and Payments” is changed to “Statement of Cash Received and Cash Paid.”

Transition to the new standards

The changes currently being adopted to reporting for small charities (Tier 3 and 4) have been largely welcomed as positive and sensible. However, there will be some transitional issues that will present challenges to preparers and auditors, for the first year of adoption when the old standard was previously used.

Some of the key items to keep in mind are as follows:

- Comparatives will need to be restated to line up with the new categories (unless it is impractical to do so). (para C14)

- Revenue recognition changes will be treated as changes in accounting policy with an appropriate note. (para C15)

- Adopting the revaluation provisions will need to be acknowledged as a change in accounting policy. (para C18)

- An entity previously using a Tier 2 standard may continue to do so, or change to the new option, however, this will be a change of accounting policy. (para C21)

Note that there may still be the requirement to use Tier 2 standards where consolidated financial statements, investments in associates or joint ventures, or joint arrangements are involved. (para D1) It may also apply other specific standards to specific transactions. (para D2)

We have included checklists for the new standards, including transitional requirements, in our new Tier 3 and 4 (NFP) Review (2023) templates, our new Tier 3 and 4 (NFP) Audit (2023) templates, plus we have stand-alone checklists for preparers of financial statements to use.