1 July 2025

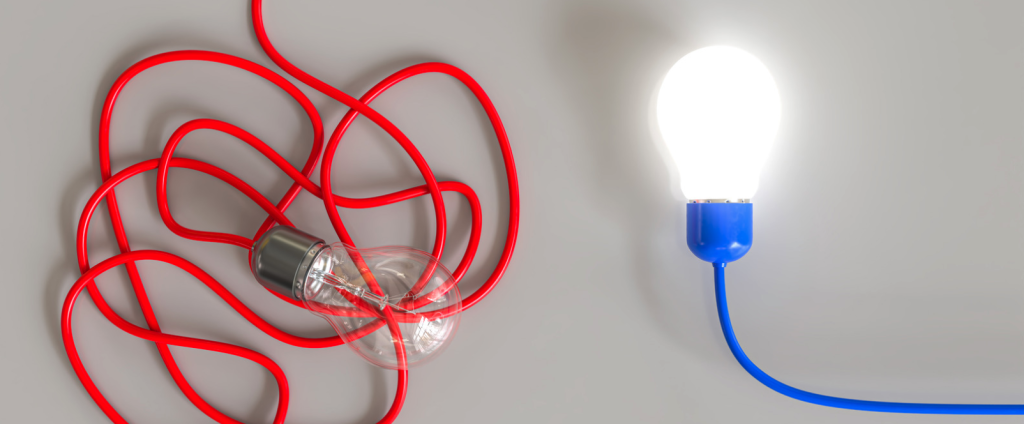

The new Less Complex Entities Auditing Standard has at last been approved for NZ. This represents the biggest change in the audit landscape since the ISAs (NZ) were adopted in 2009, potentially with a great impact for a fit-for-purpose standard for the great majority of NZ entities requiring audit.

In this article we consider who the new standard applies to, when it applies, and what Audit Assistant is planning to do to release templates to carry out this work.

I have written about this a lot in the past, starting in 2021 with hot anticipation, then again with some impatience back in 2023. I was dismayed when it was rejected by the Australians and wrote a pleading submission back in 2024 – summarised here.

So who can be an LCE?

Our previous articles discussed the content, but there were a few questions unanswered such as the potential inclusion of Public Sector and Tier 2 entities, which to my thinking could hardly be regarded as less complex. This was offset somewhat by the relatively low allowable level of size of management team (5 or less), and 5 individuals or less involved in financial reporting.

As it turns out that standard setters haven’t really changed much. There are certain prohibited classes, then some broad common-sense guidance around qualitative factors.

Part A of the standard sets out the authority for determining the appropriate use of the ISA (NZ) for LCE. This includes both the specific prohibitions – very high level entities as you would expect – and qualitative characteristics. Significantly, quantitative characteristics are not a factor (e.g. level of income, expenditure or assets). Public Sector audits may use the LCE standard if they meet the Part A requirements.

Entities that are prohibited (Para A.1) are:

-

- Listed entities and FMC reporting entities;

-

- Deposit takers (banks etc);

-

- Insurance providers;

-

- Those prohibited by legislation or regulation;

-

- Jobs carried out in a jurisdiction that does not recognise the standard;

-

- A group where Component auditors are involved (except where a physical presence is needed for a specific audit procedure like attending a physical inventory count or physically inspecting assets or documents).